Posted by Candace Brown

Posted by Candace BrownBy Bert Ely

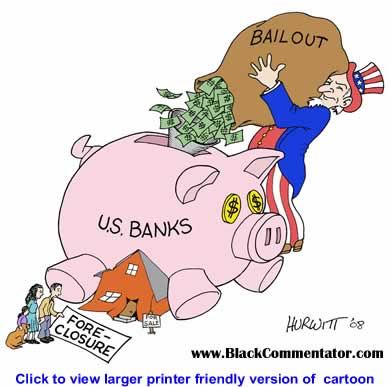

There is a widespread belief that banks are now refusing to lend as much as they should, and that Congress should pressure them to extend more credit to consumers and businesses.

In reality, banks as a whole increased their lending during 2008 -- the notion they haven't is based on a misunderstanding of U.S. credit markets. Pressuring banks to lend more could backfire.

Lost in too many discussions of the financial sector is that banks and other depository institutions account for only 22% of the credit supplied to the U.S. economy (down from 40% in 1982). "Shadow banking" -- notably asset securitization and money-market mutual funds -- now supplies 33% (up from 14%). Insurance companies, other financial intermediaries, nonfinancial firms and the rest of the world provide the balance.

As far as commercial banks go, Federal Reserve data released last week show that their lending increased 2.36% during the last quarter of 2008. For all of 2008, commercial-bank lending rose by $386 billion, or 5.63%, even as the economy slid into recession. Over that 12-month period, business lending jumped $152 billion, or 10.6%, real-estate loans were up $213 billion, or 5.9%, and consumer lending rose $73.5 billion, or 9%. Other categories of bank lending such as loans to farmers, broker-dealers and governments, declined $53.2 billion, or 5.4%.

There is a widespread belief that banks are now refusing to lend as much as they should, and that Congress should pressure them to extend more credit to consumers and businesses.

In reality, banks as a whole increased their lending during 2008 -- the notion they haven't is based on a misunderstanding of U.S. credit markets. Pressuring banks to lend more could backfire.

Lost in too many discussions of the financial sector is that banks and other depository institutions account for only 22% of the credit supplied to the U.S. economy (down from 40% in 1982). "Shadow banking" -- notably asset securitization and money-market mutual funds -- now supplies 33% (up from 14%). Insurance companies, other financial intermediaries, nonfinancial firms and the rest of the world provide the balance.

As far as commercial banks go, Federal Reserve data released last week show that their lending increased 2.36% during the last quarter of 2008. For all of 2008, commercial-bank lending rose by $386 billion, or 5.63%, even as the economy slid into recession. Over that 12-month period, business lending jumped $152 billion, or 10.6%, real-estate loans were up $213 billion, or 5.9%, and consumer lending rose $73.5 billion, or 9%. Other categories of bank lending such as loans to farmers, broker-dealers and governments, declined $53.2 billion, or 5.4%.

To read more click here:

No comments:

Post a Comment